How To Become

Profitable Trader

In One Year?

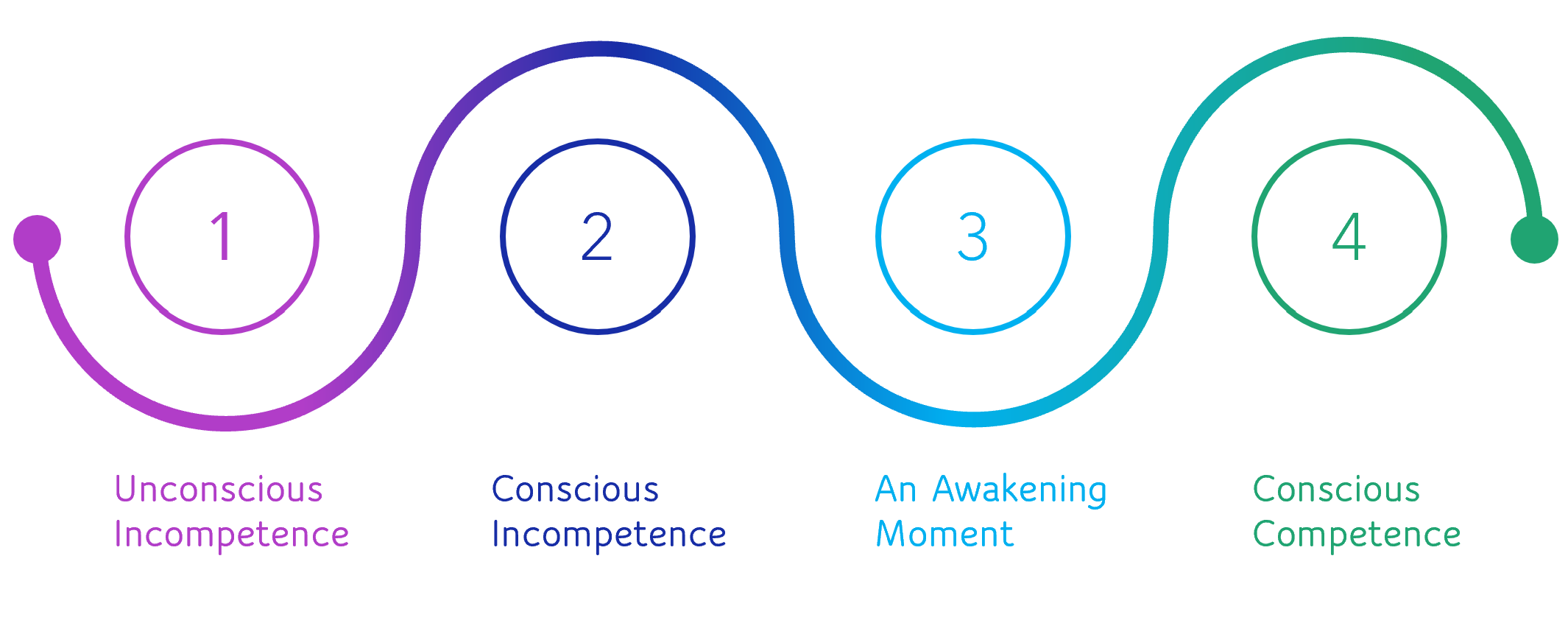

Learning To Trade Is Psychological Process Through Five Stages

5)Unconscious

Competence

3/5 Awakening moment

A basic understanding that you will never be able to predict what will happen in the markets, starts to form. You begin to realise that making money is based on a series of trades that incorporate winners and losers, and that it takes discipline to stick to a system, cut losses short and let profits run.

4/5 Conscious competence

Risk management becomes the key trading element and the approach is taken to build an account up over time and not to try to get rich quickly. During the conscious competence stage, it still takes effort to be disciplined, however losing trades will be easier to deal with because the trader understands it is part of their system.

5/5 Unconscious competence

Person is able to trade in an almost automatic mindset. A disciplined approach requires very little effort and has become second nature.

Get Access

Average

Learning Curve ©

Trader.Think ©

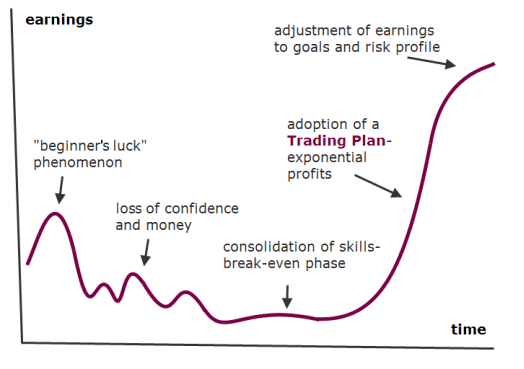

Trading is profession like any other profession which requires significiant time and deep commitment to become a successful trader. Malcolm Gladwell says that the best people excell their craft after 10.000 hours practice.

Trading reflects human performance like any other top athletic endeavor. You must understand you are responsible for the results you get.

Boring = Difficult. Profitable trading may be boring, because it is extremely difficult to open a trade upon a strategy and wait for the result.

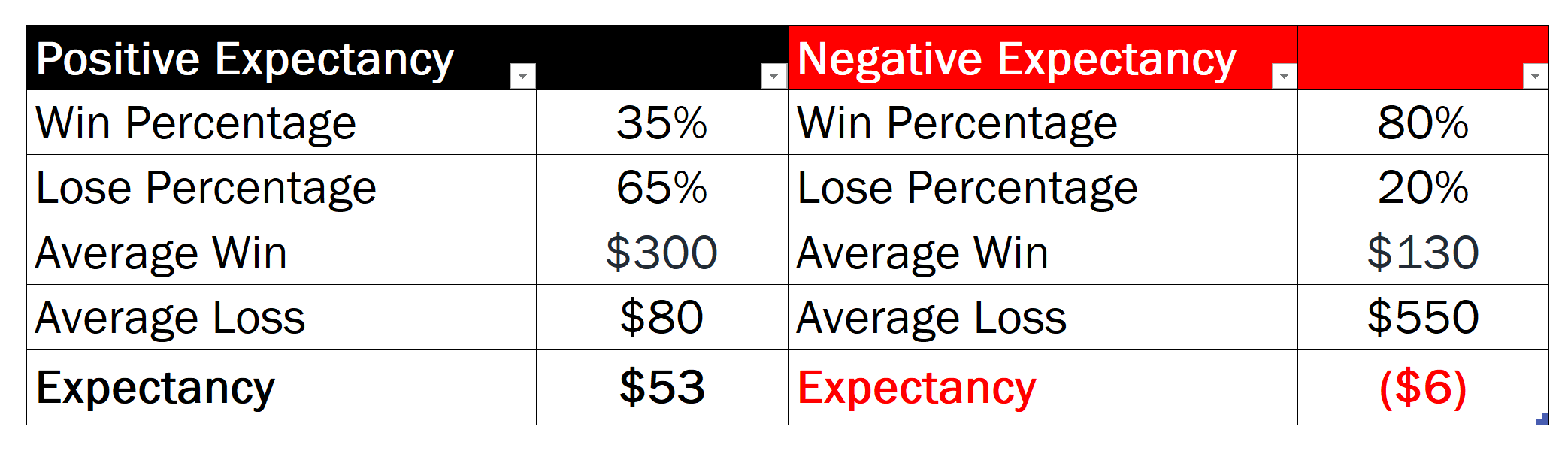

Positive Expectancy

Negative Expectancy

Loosing streak. Remember that even skilled, winning traders will go through losing periods, sometimes even 60-70% of the time.

BUT they may still have huge profits after all because of sticking to trading strategy.

Follow Low-Risk Ideas. They have a long-term positive expectancy traded at a risk level to allow for the worst possible occurrence in the short term so that you are able to realize the positive expectancy in the long term.

Expectancy and probability are two different things. Example: if you win only 30% of the time, but once it happens then it’s a 5xReward gain and once you loose it is 1xRisk then your expectancy is positive: 3x5R wins – 7x1R losses = +8x into your account.

Live Prices In Action

Trader.Skills ©

Mastered By Pro Traders

Mastering Risk Control. This is the basis for everything in trading. If you don’t control risk, you have no chance of success as a trader.

Mastering Position Sizing Strategies. Understanding position sizing strategies is critical before you can reach your goals as a trader.

Mastering Stress Control. We have a simple lesson on stress control because if you are too stressed, you cannot trade well.

Mastering Trading Beliefs About The Market. Not the markets itself, beliefs are not true but hopefully, you can and must go beyond them.

Mastering Mental State Control. Every trading day, before and also during managing open positions.

Mastering Self-Sabotage Concept. In humans natural state, profitable traders have ability to see the market just as it is. No thoughts come up to remind you of the past or attempt to predict the future. Instead, they see exactly what’s happening in the market. And from that flow state, an amazing level of trading is possible.

Mastering Daily Taks: Self Analysis, Focus and Intention, Developing a Low-Risk Ideas

Mastering Trading System That Fits Personally. Developing unique or use already existing system that allows compatibility with specific beliefs, objectives, personality, and personal edges.

Mastering Low Risk – High Reward Trade Ideas. An idea with a positive expectancy that is traded at a risk level that will allow you to survive in the short term, so that you can achieve the positive expectancy over the long term

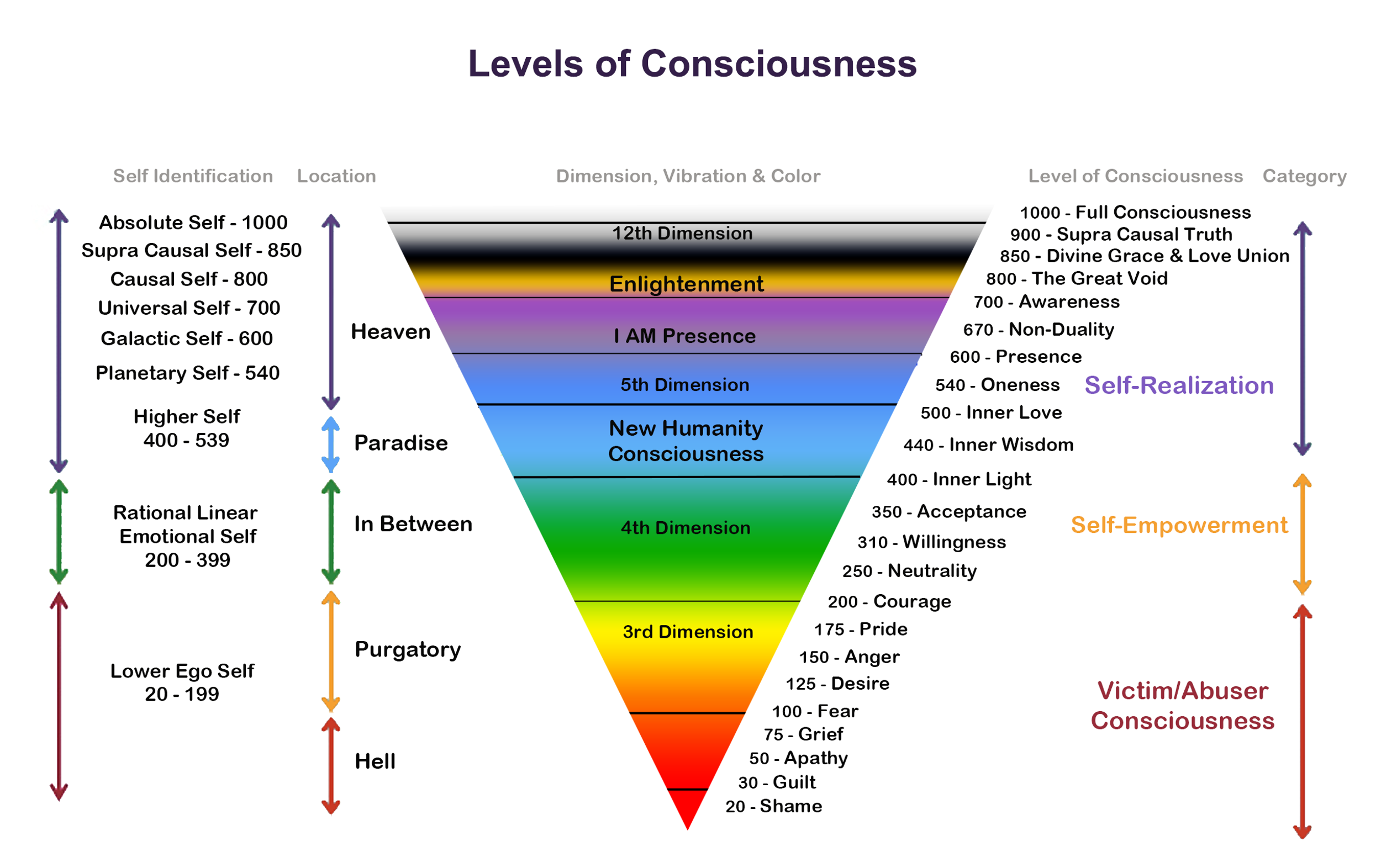

Dr. David Hawkins

Consciousness

Trader Target:

350+ (acceptance)

Low Risk

High Reward ©

Risk management allows us to know exactly where we wish to exit the market. It provides a firm plan to exit a position if the price turns against us.

BUT they may still have huge profits after all because of sticking to trading strategy with optimized Risk To Reward (R/R) ratio.

Single most important aspect of managing your money in the markets. The ratio refers to the number of pips we expect to gain on a profitable trade versus the number of pips we risk in the event of a loss.

Willpower. Do you have the willpower to let your profits run for four or five days? Or do you rush in the minute it shows a profit and get out?

If the trade runs against you, are you going adjust your stop “because it will turn around soon” or will you be able to stick with your original risk parameters by applying good risk management?

By establishing 1:3 or even 1:6 risk/reward ratio for your winning trades, you should be able to make money over time even if you lose a majority of your trades.

BIG

picture

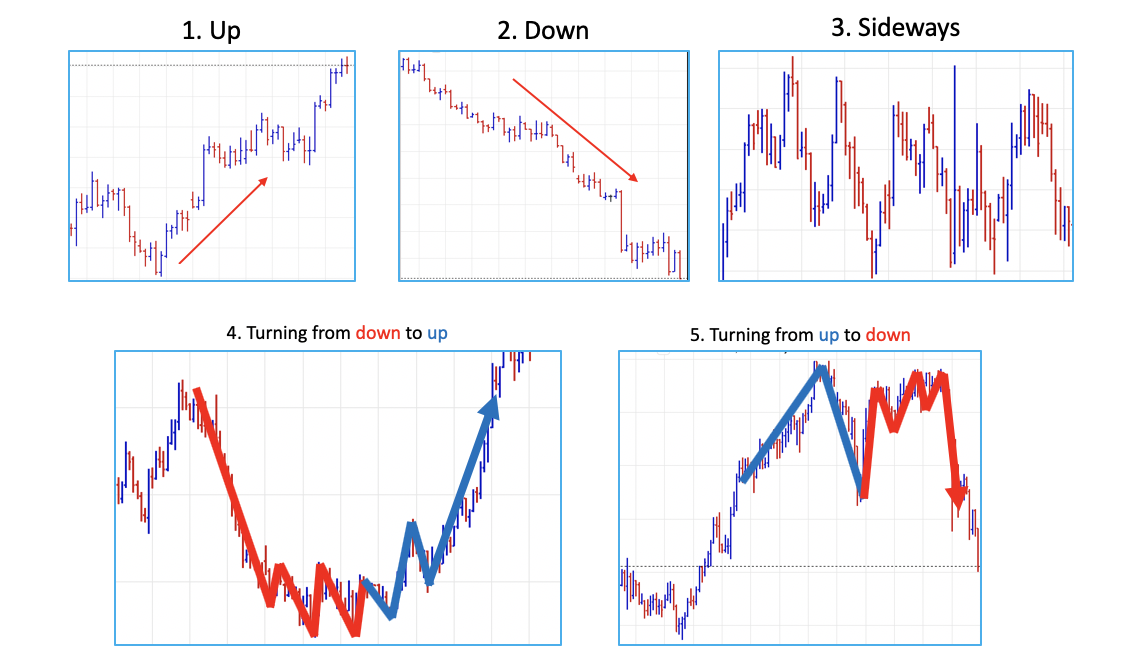

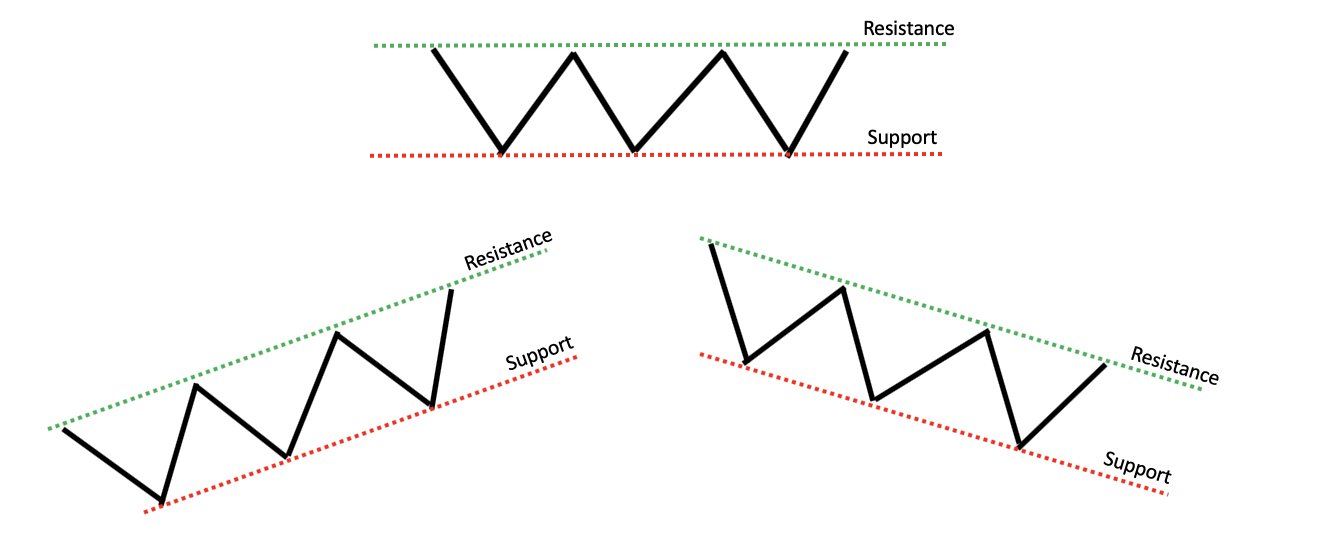

Get idea at daily chart first. This is the best way to understand where the market is heading.

Assess the phase or trend of the market. There are 5 possible phases in the market. Up, Down, Sideways, Reversing-up, and Reversing-down.

Fundamental

Patterns ©

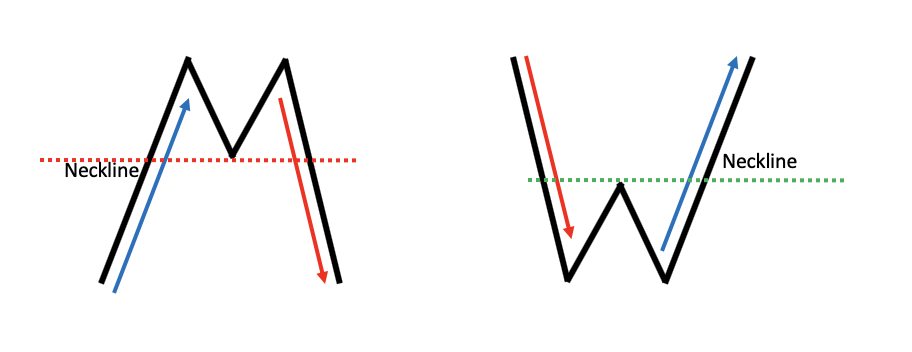

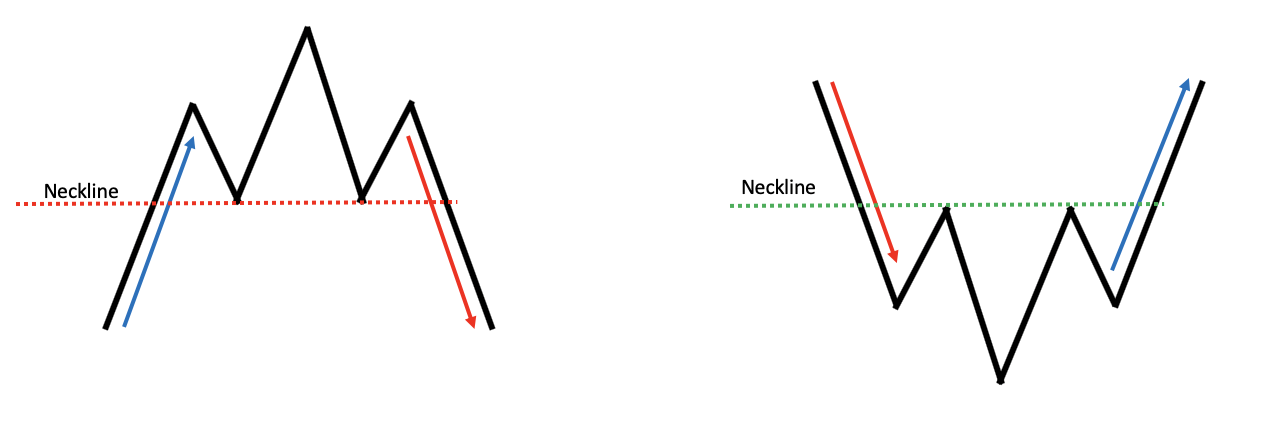

Double Top

Double Bottom

Head & Shoulders

Inverted Head & Shoulders

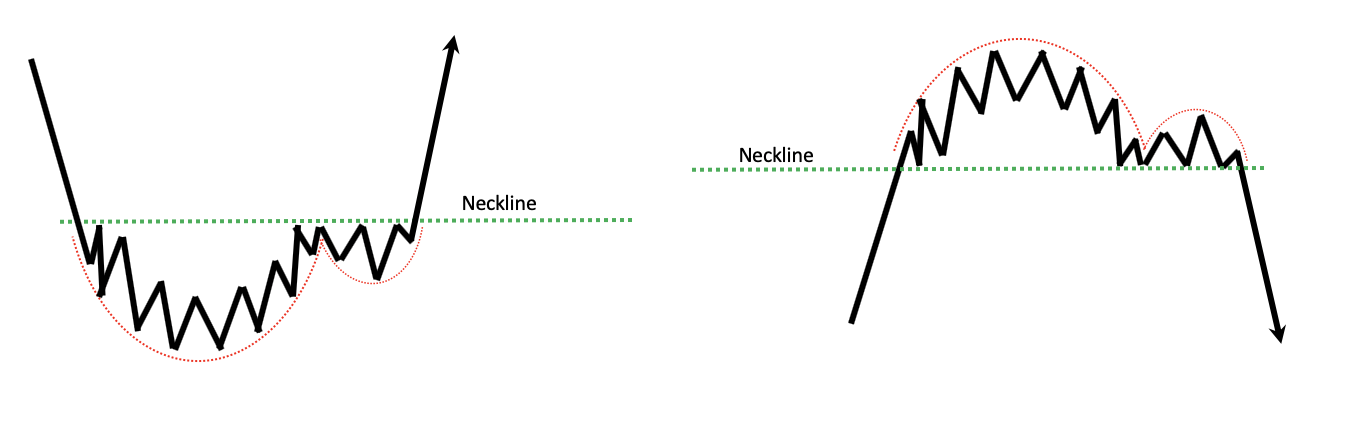

Cup &

Handle

Ascending &

Descending Triangle

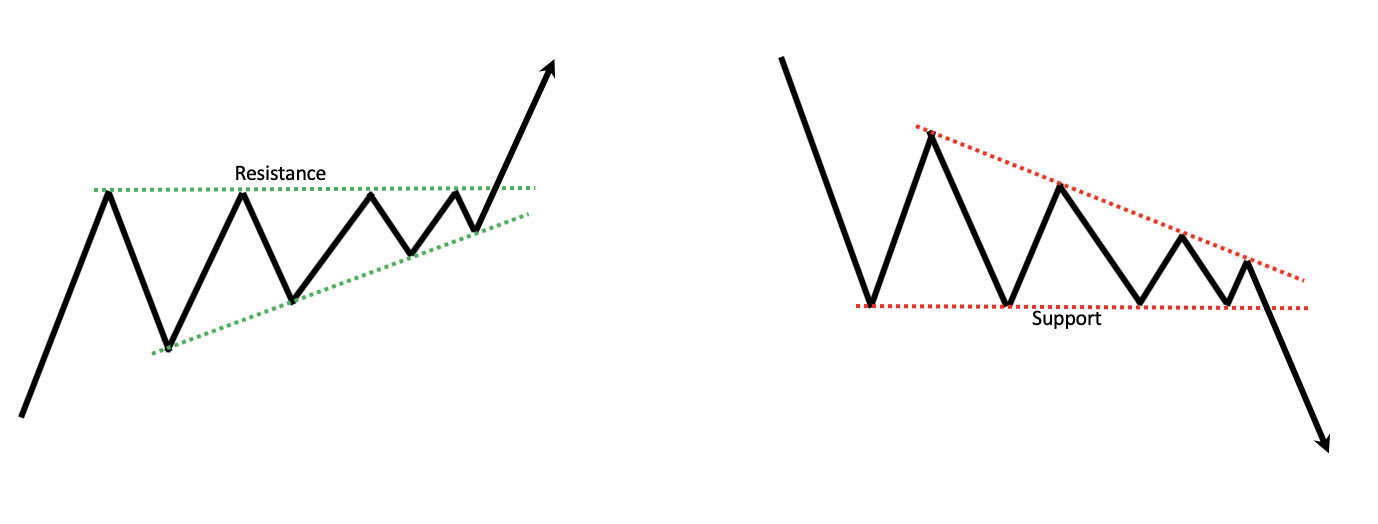

Channels

Trader.Mistakes ©

self-sabotage

Stopping one mistake could save you thousands of dollars. Having worst-case contingency plan keeps you in a game and avoid blowing up trading account.

Not following the rules. If you do not have trading plan/strategy that all trades are mistake by definition.

It is important to know how to feel good and reward yourself for doing things that are positive for you. It doesn’t come overnight, it is a constant thing. There is no benefit in blaming myself for things I have no control over. I am a human being, and I am going to make mistakes. I am not perfect, and that’s the way life is. I just pick up and try again.

Learn how to face reality. When plan does not work as expectations, sell position immediately without hesitation, keep your losses short.

Stay in current moment. If you are going to trade be sure you act upon todays market and leave what was yesterday or do not trade your account.

Get Access